- Home

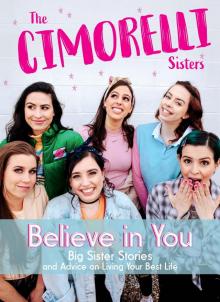

- Christina Cimorelli

Believe in You Page 11

Believe in You Read online

Page 11

* * *

Ultimately, nothing you buy is going to change how you feel.

* * *

Dani

It’s true: spending money makes you feel good. You get clothes that are trendy to make you “fit in,” buy makeup because it makes you “prettier,” or go out to dinner with your friends even though you don’t necessarily have the money for that. Being aware of this is so important when it comes to being smart with money because sometimes you end up at the store spending half your paycheck on new clothes that you didn’t need simply because you don’t think twice about it. Every time I feel the urge to spend, I ask myself, “Do I really need this?” or, “Am I actually going to use this?” And it has kept me from purchasing so many unnecessary things.

Whoever loves money never has enough; whoever loves wealth is never satisfied with their income.

ECCLESIASTES 5:10 NIV

Katherine

If you feel like you’re constantly thinking about the next thing you want to buy, and you’re never satisfied, I would recommend asking yourself if this is a pattern you see carrying on to other aspects of your life. I know you’ve heard it before, but what they say is true—money CANNOT buy happiness. Yes, you do need money to live. And lack of it is definitely going to cause you anxiety. But it is an absolute and essential truth: even though there are lots of emotions connected to money, you cannot buy happiness! Lasting happiness comes from a relationship with God, having healthy and strong relationships, cultivating gratitude, and learning how to be content with and grateful for what you already have. Seriously! So many of the things that make us truly happy don’t cost anything at all.

SWAPS AND UPGRADES

If you’re about to spend money on something for emotional reasons, you have to ask yourself, “Am I trying to get something money can’t buy?” Substitute those purchases for something that’s as good, if not better—and often free!

Katherine

Swap beauty purchases for cultivating your inner beauty. We want to feel beautiful, so we buy makeup and hair products. But true beauty comes from learning to love what’s unique about us, showing love to the people in our lives, and cultivating virtue in our character, such as patience, generosity, charity, and compassion. True beauty is someone who is full of light and who other people want to be around because of how radiant that light is. It is so much deeper than mascara and a good haircut!

Christina

Swap these quick fixes for something better:

•comfort food → a relaxing bath

•brand names to fit in → connecting with true friends

•sugar for the sugar rush → going to a park and having fun like you’re a kid again

•buying things to post on social media to up your status → getting off social media and reconnecting with real people in your life instead

HOW IMPORTANT IS SAVING?

Something a lot of older adults say is that, looking back, the one piece of advice they would give their younger selves about money is this: Save. Start young. Do it! Saving money is a habit that will pay off in a huge way down the line, and developing the habit now will give you an incredible advantage. Here are our best practices.

* * *

Save. Start young. Do it!

* * *

Christina

I would always hear people preaching to me about saving money, and for a long time, it went in one ear and out the other. Nothing changed my mind or whipped me into shape like these two things did:

1.Having to pay bills.

2.The idea of having more in my bank account this month than I did last month.

Make the goal to have a certain amount more in your bank account each month and to watch the number go up month by month. After the first few months of watching it go up, you’ll be excited and empowered to become even more creative about finding ways to make more money and spend less money.

Lisa

How do you save money? Stop spending it. Ha! Seriously though. Don’t spend it. Here are some of my tips on saving money:

•There are so many fun things to do that are free. Make a list of your favorite memories from the last few years and put a star next to each thing that didn’t cost money. Then think if there’s a way you could’ve made the other items on the list free or at least cost less than they did.

•Food is a HUGE money suck. Try splitting meals, cooking at home, having people over to cook with you, and bringing snacks instead of buying them while you’re out. All of those things will help so much!

•Another big money suck is CLOTHING. Go through your closet and identify pieces you haven’t worn in a while and other things you could wear with them that you haven’t tried yet. Mixing it up is a great way to get more bang for your buck. I love shopping way too much, so feeling like I have new options is always a big help in avoiding hitting up the mall.

Lauren

I know that saving money can be really hard. We want to do all these fun things that cost money. The idea of saving can make you feel like you’re in a prison, but actually it frees you!

If you have money saved up, you can do the things you want to do, like buy a car, move out, invest in your passions, or buy a nice camera or software or supplies. You can reach bigger goals with that money.

If possible, and especially when you’re living at home with minimal to no expenses, save at least half of your income every month. Put it in a savings account, and do not touch it. If you’re saving up for something expensive, do not save up until you have that exact amount and then spend your entire life’s savings on it. Save enough so that you have a good amount of money left after you buy it.

* * *

If you have a job, you should have at least $1,000 saved at any given time.

* * *

If you are in the habit of spending all your money as soon as you get it, stop. If you have a job, you should have at least $1,000 saved at any given time. This might sound like a huge number, but it doesn’t have to be that hard. Look for little ways to save. Get creative. You will be so much more in control of your life if you start building a cushion of savings.

FUN, FREE THINGS TO DO

•movie night at home

•playing hide-and-seek on your street in the summer

•baking/cooking dinner (with food you already have)

•walking around your neighborhood

•going to a park

•going somewhere with a cool view

•making weird/fun videos

•going to free events in your town

•listening to music

•learning something new on YouTube

•taking a free local class of some sort (check online to see what’s available in your area)

•exploring your town on a walk or on a bike

•drawing or taking pictures

•making up a dance with your friends and filming a video

•going on walks with your friends or hanging at each other’s houses instead of going to coffee or out to eat

•giving a friend a “makeover”: doing her makeup and hair and picking her outfit (or you can do it for each other)

•reorganizing your room so it feels new

•getting a group of friends together for an outdoor game—the more people, the more fun it is! (Use Google to find ideas of games)

Katherine

I am not a naturally thrifty person. I have a huge appetite for life, and I want to experience everything—every road trip, concert, dinner at a fun restaurant, and night out with friends. Being a very social person and being thrifty do not seem to go hand in hand.

But it helps if I focus on the positive aspects of saving money. Where I used to equate saving with being bored and missing out on fun things, now I focus on the good things about saving, such as freedom and being financially secure, which also means being more relaxed and less stressed! There is also the serious side of saving, such as having a “rainy day fund,” which basically means having m

oney saved in case of emergency.

Several years back, I had a really stressful situation where I had to pay out of pocket for an expensive oral surgery, and I was not financially prepared for it. My tooth was basically dying in my mouth out of the blue—something you never would expect to happen in your early twenties! I had the down payment saved up, but the second half took me over a year to pay off. I had never been in any debt before, and I felt so deeply ashamed. When I finally finished paying it off, it felt as though a huge weight was off my shoulders.

Since then, I have worked hard to live in a more disciplined way when it comes to saving, and I am happy to say I learned to live on a budget and save up the extra money I never had as a teenager! It’s such a comforting feeling knowing that if a surprise expense comes up, I can pay for it without worry.

HOW TO BUDGET

Saving and budgeting go hand in hand. But does the word budget make you want to hide under a rock? Do you associate it with boredom and eating plain oatmeal and canned soup? It’s time to take back budgeting and call it what it is: planned freedom.

* * *

It’s time to take back budgeting and call it what it is: planned freedom.

* * *

Amy

Money can be a source of great stress or a great tool. It all depends on the habits you make when spending it.

The basic principle of budgeting is as follows: spend less than you make.

You make a budget by first figuring out how much you make a month, and then you figure out what you spend your money on. Finally, you figure out how much of that you are willing to spend on the things you want and need.

Let’s say you make $500 a month. A budget would look like this:

$500

total

$75

$75

$75

$275

gas

eating out and fun money

shopping

saving

Now you try. Maybe you need to keep track of your spending for a month in a little notebook or on your phone so you know where the money is going. Once you know, divide it up into your categories, and make your budget official. Stick to your budget and save your money. That’s how you make good money habits!

You may be asking, But what if I’m completely broke? Where is all that budgeting money going to come from? Don’t stress. You can look into a few ways you can make money over the summer and through the school year. Having a job can help you feel empowered and productive. It can help you get the skills you will need later in life. Working at different places is also a good way to find what you want to do for a career.

Here are a few examples of places you can work or tasks you can perform to jump-start your income:

•a movie theater

•a restaurant

•a store

•lifeguarding at a pool

•babysitting

•odd jobs

•mowing lawns

•teaching some sort of lessons

Making a starter income and handling that income wisely will put you well on your way toward a good financial future.

Amy

I am not a financial planner or professional finance person, but I’ve read that you should figure out your expenses in your budget and have at least six months of them saved. This applies more to later in life, when you live on your own. If you have this money saved, you could even move somewhere fun or start a new venture. You will be okay if you suddenly lose your job because you have that money set aside. This will greatly reduce your stress as you get older. Saving your money and using it wisely will help you have a more secure and stress-free future!

Dani

I want to talk for a minute about sticking to that budget you just made. You have to be strong when your friends want you to spend extra money you don’t have. Be honest with your friends, and stay out of situations where you could potentially spend extra money and mess up the budget. So, for example, if your friends always want to go out, don’t say you’ll go with them and not spend if you are prone to spending. And don’t try to hide the fact that you’re saving! Be real and just say, “I’m saving for x, so if you could help me out by doing more free things, that would be really helpful.” If you’re saving for something really amazing or important, that’s something to be proud of. Saving and budgeting your money isn’t lame, stupid, or something to be ashamed of. Your friends should support and help you—and if they don’t, maybe they’re not true friends.

MONEY TOOLS

Once you’ve got yourself in a saving and budgeting frame of mind, there are all sorts of tools you can use to keep you on track and get you where you want to go.

CHECKING AND SAVINGS ACCOUNTS

Amy

The first thing you should do when you start making money is open up a savings account. (Ask your parents for help if you are under eighteen.) The first step is to research banks. Once you have found the bank you want to use and that makes the most sense for you, call them up and make an appointment. You can also ask if you can set up an account online. Then they will walk you through all the steps when you open your account with them.

In the beginning when you are starting out with budgeting, it can be helpful to withdraw all the physical money you want to spend that month and only use cash. Leave your card at home. Cards involve a lot of self-discipline so you don’t go into debt. Once you have mastered discipline with paper money, you can move on to a card.

A WORD ON CREDIT CARDS

Lisa

My main advice with credit cards is to treat them like a debit card. Don’t get in the habit of spending money you don’t have! Always keep track of how much you have in your account so you know you have enough to pay off your credit card every month. Also, make sure to set an alarm on your phone each month a few days before your bill is due, and pay it a little early. That’s my go-to trick for avoiding late fees.

MONEY APPS

Christina

For technology, I enjoy using the app Mint because it shows me how much I’ve spent on each category, how much cash I currently have in my accounts, and if I’m overspending in a category when I may not have noticed.

Lisa

I love apps that help you keep track of spending! There are a lot of good options that will analyze your income versus spending and give you regular updates of where your accounts are. If you’re not comfortable giving your banking information to a third party, you can always use your Notes app to jot down how much you’re spending on food and entertainment each time you make a purchase. I know that might sound tedious to some, but it REALLY helps to know how much you’re putting down each month (especially if you’re just starting out), and it only takes a few seconds to write things down. If you don’t know how much you’re spending or what you’re spending it on, how can you know what to work on and improve? Knowledge is power, so make sure you know!

QUESTIONS TO ASK YOURSELF

Katherine

Last year I got really into a concept called minimalism. I read books on it, watched documentaries and YouTube videos on it, and read articles as well. It’s definitely a trendy word right now. I think a lot of people assume it means to literally get rid of everything you own down to the bare necessities. But I took a less extreme approach: I started to ask myself questions and simplify my life.

I went through all my shoes, clothes, books (this one was the hardest ’cause I love my book collection), and other belongings and asked myself if each item really was useful or brought value to my life. I was surprised to realize I had a lot of things I held on to and I wasn’t even really sure why. Getting rid of them freed up space in my house, and my environment felt lighter and more open.

* * *

It all comes back to being self-aware and asking yourself, “Do I really need this? Or even want it?”

* * *

This especially affected the way I now buy things. It’s easier to realize I’m being or careless and decide not to purchas

e something. I think it all comes back to being self-aware and asking yourself, “Do I really need this? Or even want it?” and with clothing especially, saying, “Do I love this? Or just kind of like it?” Find your own money philosophy and ask yourself questions that point you back to it. If you figure out what you’re going to do ahead of time to remind yourself of your goals, there’s less struggle in the moment.

Lauren

I love fashion, and I love buying new clothes. But to make sure I don’t overspend, I have a trick: I don’t look at the tag before I try it on, and then once I have it on, I tell myself how much it’s worth. Like, Okay, this shirt is cute, but I would only pay ten bucks for it. Then, if you check the tag and it’s fifteen dollars, you don’t buy it!

Also, if you have something you are saving for, use that as a tool to stop yourself overspending. Just remind yourself of how good you will feel once you have saved up the money for that car or that new phone or that concert or that trip! Ask yourself, How much more important is my goal?

YOUR MONEY FUTURE

If you’ve been in church much, you may have heard the term stewardship. That’s the idea that we are simply guardians of the money and resources God has given us, and we get to steward or manage them well. That affects the way we save, spend, and give. It also affects the way we look at our future. How can we be smart about what’s to come?

Amy

Right now I am saving up for my future. I am saving so I can invest money easily and have a good safety net. But I haven’t really thought about where faith and money intersect until recently. We are cared for and loved by God, who wants to help us and provide for us. He gives us so much, and it is our responsibility to help others with what He has given. I have recently started giving a tithe (10 percent of one’s income given to a church or to God’s work in the world). I think that is a great way to say thank You to God and that you trust in Him to provide for you. You are literally giving of what He has given you so that others may be helped by His abundance!

Believe in You

Believe in You